World's Fastest

Bond Elections

In November 2021, voters approved a bond election authorizing the issuance of $31,550,000 in unlimited tax bonds. These bonds will be issued over the next 15 to 20 years, as needed, to fund improvements to the District’s waterworks and wastewater treatment system (the “System”), including the repair or replacement of existing facilities. Each series of bonds, once issued, will be repaid through annual ad valorem taxes levied on all taxable property within the District.

Much of the District’s infrastructure was constructed in the early 1960s and is now nearing the end of its functional lifespan. Many valves and pipelines are reaching a critical stage of deterioration. When a failure occurs, the system can no longer be isolated to a single street, which means a break could result in widespread outages across multiple areas.

The Board’s primary responsibility is to maintain and operate the System efficiently. As repairs, replacements, and upgrades become necessary, portions of the voter-approved bonds will be issued. Over the past decade, growth in the District’s taxable values has helped offset the impact of new debt, keeping tax rates stable. While future growth cannot be guaranteed, the Board continues to encourage both residential and commercial development within the District.

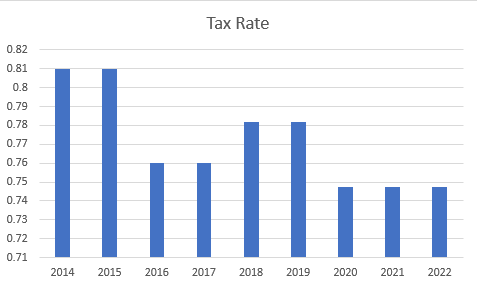

To estimate the impact of issuing the $31,550,000 in bonds, certain assumptions must be made. If the District experiences 3.5% annual growth over the next seven years (compared to the actual 12% average growth over the last decade), and the bonds are sold in five increments over the next 15 years at current market rates, the tax rate could rise by about $0.02—from $0.7476 to $0.7676. For homeowners, this would equal roughly $20 more per year on a $100,000 property.

If the bond election does not pass, the Board must still maintain and operate the System. The alternative would be to issue revenue bonds, which do not require voter approval but are less attractive in the marketplace and carry higher interest rates. Revenue bonds also pledge net revenues from water and sewer services rather than property taxes. Because most high-value taxpayers are commercial entities with relatively low water and sewer bills compared to their property taxes, this funding method would place a heavier financial burden on homeowners. If $31,550,000 were issued as revenue bonds over the next 15 years, the average homeowner’s cost could rise by about $20 per month within five years, and as much as $120 per month within 20 years.

The District is committed to being a responsible steward of taxpayer funds and has consistently worked to reduce the overall tax rate. Since 2014, the District has lowered the rate by just over half a cent per $100 of property valuation. With the new bond, the District intends to maintain the current tax rate while also refinancing existing bonds to secure lower interest rates and reduce the District’s overall debt.